- Home

- Accounts Payable

- Accounts Payable and the Self-Employment Tax in Santa Rosa

Accounts Payable and the Self-Employment Tax in Santa Rosa

Get The Help You Need

Accounts payable and the self-employment tax in Santa Rosa should be understood by every Santa Rosa business owner. This begs the questions: 1. What is the self-employment tax? and 2. How does it affect you as a business owner?

Most Santa Rosa business owners realize that they must pay a variety of taxes, including federal income taxes to the IRS, sales taxes, a state income tax to the California Franchise Tax Board and business taxes to the City of Santa Rosa.

However, many entrepreneurs aren't aware that they must also pay a federal self-employment tax. Here is an overview of the tax and some of the important factors that you need to understand.

Accounts Payable and the Self-Employment Tax in Santa Rosa

Many business owners mistake the the accounts payable and the self-employment tax in Santa Rosa with the federal income taxes every business owner is required to file each year.

It is a separate tax used specially to fund the Medicare and Social Security programs.

It is commonly referred to as the FICA tax. You will also be responsible for calculating these taxes for any of your employees.

However, for this article we focus on the FICA taxes that you owe personally - the self-employment tax. We hope the following information clears up any tax questions that you may have.

How Much is the Accounts Payable and the Self-Employment Tax in Santa Rosa?

How much do you need to pay for the self-employment tax? That is probably the most important question on your mind. Fortunately, the calculations are pretty simple.

The 2015 tax rate for Social Security is 12.4% and the tax rate for Medicare is 2.9%, which means that the total payroll tax 15.3%. Every member of the workforce is legally required to pay this tax.

The tax is split evenly between the employer and the employee, but independent contractors are responsible for the entirety of the tax, because they are legally considered both their own employer and employee.

Many self-employed workers are discouraged that they are required to pay more taxes to the IRS. However, there is a silver lining – the IRS allows you to deduct half of your self-employment tax as a deductible business expense, which reduces your federal income tax.

Meeting the Deadlines

The payroll tax must be paid every three months. The official deadlines are:

- April 30

- July 31

- October 31

- January 31

You should document accounts payable and self-employment tax transactions to make sure that you don’t fall behind.

Companies that receive or sell large volumes of goods or services should tally their sales and expenses each month to determine their estimated profit or loss and calculate the self-employment tax they will owe.

Example of Account Payable and Self-Employment Tax in Santa Rosa Calculation

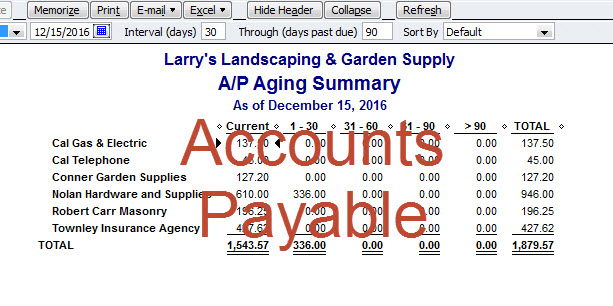

Accounts Payable Santa Rosa Example

Accounts Payable Santa Rosa ExampleThe bookkeeping process for recording self-employment tax transactions is pretty straightforward. You will need to create the following double bookkeeping debit entries to record the taxes owed:

- A debit entry for your payroll tax expense

- A credit entry for the FICA tax payable (this is the GAAP standard account name for the self-employment tax)

The bookkeeping practices seem pretty straightforward, but what do they look like in practice? Here is an example to understand it in more detail.

Example:

In January, Frank generated $5,000 in profit from his auto repair shop in Santa Rosa. Since the self-employment tax is 15.3%, he will owe $765 to the IRS.

He wants to keep track of the money owed to the IRS, so he records the following bookkeeping entries:

Account Debit Credit

Payroll Tax Expense $765

FICA Tax Payable $765

Frank earns the same income in February and March, which means that his total self-employment tax for the quarter is $2,295. He records similar transactions each month, files a 1040-ES with the IRS and makes the payment.

After paying the quarterly self-employment tax, he needs to make another double bookkeeping entry as follows:

Account Debit Credit

FICA Tax Payable $2,295

Cash $2,295

The calculations are pretty simple, but you will need to make sure that you keep up to date to avoid any fines or penalties for late payments.

We Can Assist You

Accounts Payable and the self-employment tax in Santa Rosa as well as other cities is one of the most frequently misunderstood elements of the tax code.

Unfortunately, there are serious consequences if you don’t pay it on time. The good news is that the process is very straightforward if you take the time to study it.

However, you can always speak with a professional licensed bookkeeper if you need additional assistance.

Please don’t hesitate to contact us if you need

further assistance with accounts payable and self-employment tax in Santa Rosa.

We would love to help you.

Accounts Payable Articles

- Accounts Payable Recording Outstanding Bills

- Accounts Payable and the ACA in Santa Rosa

- Accounts Payable and the Self Employment Tax

- Accounts Payable Journal Entries

- Accounts Payable Journal Entries for IRS Audit

- Accounts Payable Petaluma

- Accounts Payable Santa Rosa

- Accounts Payable Affect Cash Flow

- Accounts Payable In Santa Rosa

- Accounts Payable JE's for Growing Businesses

- Accounts Payable Spreadsheet

- Auditing Accounts Payable

- Bookkeeping Services and Accounts Payable

- Calculating Accounts Payable

- Accounts Payable Journal Entry

- Ideal Accounts Payable Turnover

- Improve Accounts Payable Turnover

- Accounts Payable and Minimum Wage Increases

- Streamlining Accounts Payable

More Tax Articles

- Bookkeeping For Tax Changes

- Business Taxes

- Estimated Tax Payment

- Income Tax Deductions

- Income Tax News

- Income Tax Questions

- Income Tax Resolution

- Online Income Taxes

- Self Employment Tax

- Small Business Tax Services

- Tax Organizer

- Tax Policies For California

- Tax Preparation Services

- Tax Professionals

- Tax Relief

- Tax Trivia

Questions And Answers Pages

- Accounting News Article Contributions

- Accounts Payable Questions

- Accounts Receivable Questions

- Bookkeeping Articles

- Balance Sheet Questions

- Bookkeeping News Article Contributions

- Bookkeeping Questions and Answers

- Chart Of Accounts Questions and Answers

- Funny Accounting Jokes

- Income Tax Deductions Questions

- Income Tax News Article Contributions

- Investment Questions

- Profit And Loss Statement Questions

- Your Testimonials

Please subscribe to my monthly newsletter, Bookkeeping Basics E-zine. It tells you every month about the new information that I have added, including some great tips and advice from myself and other Bookkeeping Basics readers.

Like Bookkeeping-Basics.net?

- Home

- Accounts Payable

- Accounts Payable and the Self-Employment Tax in Santa Rosa

New! Comments

Have your say about what you just read! Leave me a comment in the box below.