- Home

- Bookkeeping 101

- Balance Sheet

Balance Sheet

The Assets = Liabilities + Owner's Equity Equation

What exactly is the balance sheet? It is a fundamental financial statement that provides a snapshot of your business's financial position at a specific point in time. It offers valuable insights into your assets, liabilities, and equity, enabling you to assess the overall financial health and stability of your business.

Our comprehensive bookkeeping 101 guide equips you with the knowledge and understanding to interpret and analyze this essential financial statement effectively. We will walk you through the key components including current assets, fixed assets, current liabilities, long-term liabilities, and equity.

By examining this, you can assess your business's liquidity, solvency, and financial stability. You'll gain insights into the value of your assets, understand your liabilities and debts, and evaluate the equity position of your business. This information is invaluable for making informed financial decisions, attracting investors or lenders, and tracking the progress and growth of your business.

Our guide covers the essential elements of a balance sheet, explains common financial ratios derived from the balance sheet, and provides practical tips for interpreting and analyzing the data effectively. Whether you're a business owner, financial analyst, or accountant, our guide will empower you to leverage the balance sheet as a powerful tool for financial assessment and decision-making.

Don't underestimate the significance of the balance sheet in understanding your business's financial standing. Explore our comprehensive guide to gain valuable insights, unlock financial opportunities, and make informed strategic decisions based on a thorough understanding of your business's financial health.

The formula looks like this: Assets = Liabilities + Owner's Equity. This is also otherwise known as the Accounting Equation.

Balance Sheet Comprehensive Guide

The balance sheet is a critical financial statement that provides crucial insights into a company's financial health and position. Understanding how to interpret and analyze the balance sheet is essential for making informed financial decisions, evaluating performance, and attracting investors or lenders. Following are the concepts that will equip you with the knowledge and understanding to effectively interpret and analyze the balance sheet.

1) Understanding the Balance Sheet

- Accounting Definition and purpose of the balance sheet

- Key components: assets + liabilities = equity

2) Assets

- Current assets: cash, accounts receivable, inventory, and more

- Fixed assets: property, plant, and equipment

- Intangible assets: patents, trademarks, and goodwill

3) Liabilities

- Current liabilities: accounts payable, short-term loans, and accrued expenses

- Long-term liabilities: mortgages, long-term loans, and bonds

4) Equity

- Common and preferred stock

- Retained earnings and accumulated other comprehensive income

5) Financial Ratios Derived from the Balance Sheet

- Liquidity ratios: current ratio and quick ratio

- Solvency ratios: debt-to-equity ratio and interest coverage ratio

- Profitability ratios: return on assets and return on equity

6) Interpreting and Analyzing the Balance Sheet

- Vertical analysis: understanding the percentage composition of each component

- Horizontal analysis: comparing balance sheets over multiple periods

- Trend analysis: identifying patterns and changes in financial planning

7) Practical Tips for Balance Sheet Analysis

- Assessing financial stability and risk

- Identifying strengths and weaknesses

- Making informed financial decisions based on balance sheet analysis

Conclusion: Mastering the interpretation and analysis of the balance sheet is crucial for sound financial management and decision-making. This comprehensive guide has equipped you with the necessary knowledge and understanding to effectively interpret and analyze this essential financial statement along with the Profit and Loss Statement.

By leveraging the insights gained from the balance sheet, you can make informed strategic decisions, evaluate performance, and enhance the financial health and success of your business. Continually refining your balance sheet analysis skills will empower you to navigate the dynamic business landscape with confidence and achieve your financial goals.

Bookkeeping 101 E-Book

This Bookkeeping 101 EBook is a useful tool for business owners, bookkeepers, accountants and anyone responsible for household personal finances.

You can receive the complete Bookkeeping 101 accounting series in a 23 page E-Book for $4.97 along with all sorts of other accounting, business and financial goodies.

Balance Sheet Accounts

There are many different bookkeeping accounts that appear on the monthly and annual report.

The different bookkeeping accounts you will find can be thought of as all of the things (including money) that you own as well as all of the debts that you owe.

This would include things like bank accounts, property (buildings), equipment, furniture and amounts that people owe you (Accounts Receivable).

This also includes all of your liabilities such as bank loans, credit cards, and amounts you owe to other people (Accounts Payable).

Additional types of bookkeeping accounts that you will find are the equity accounts. These indicate what your business is worth and include all of the money (investments) that the owners have put into the company as well as all of the money, draws or distributions that the owners have taken back out.

The equity of your company is the total of all of your assets (what you own) minus the total of all of your liabilities (what you owe). This is also known as the net worth of your company.

When determining what you equity is, the accounting formula changes. Now the formula would look like this: Equity = Assets - Liabilities.

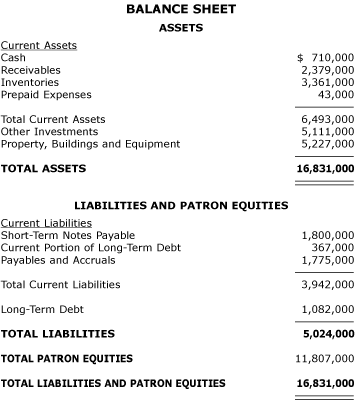

Sample B/S Report

Your b/s report may be long or short depending up the type of company you have, how many assets, furniture, equipment, and loans you have.

However a report will always have the same overall look and feel. A sample report might look something like this...

Sample Balance Sheet

Sample Balance SheetBookkeeping 101 Articles

- Accounts Payable

- Accounts Receivable

- Balance Sheet

- Bank Reconciliation

- Chart of Accounts

- Profit and Loss Statement

Please subscribe to my monthly newsletter, Bookkeeping Basics E-zine. It tells you every month about the new information that I have added, including some great tips and advice from myself and other Bookkeeping Basics readers.

Like Bookkeeping-Basics.net?

- Home

- Bookkeeping 101

- Balance Sheet

New! Comments

Have your say about what you just read! Leave me a comment in the box below.