- Home

- Accounts Payable

- A/P And The ACA

Accounts Payable And The ACA In Santa Rosa

Learn The Best Practices

Every local business needs to learn about accounts payable and the ACA in Santa Rosa. How does the new healthcare law affect your business?

Many components of the Patient Protection and Affordable Care Act (also known as the Affordable Act or ACA) took effect in 2010. However, one of the most important provisions of the law – the employer mandate, wasn’t enacted until January 2015.

This mandate creates a number of accounting changes for many employers. You will need to adapt to the new changes to avoid running

into issues with the IRS.

Federal officials and Covered California specialists have been trying to educate the public over the last couple of years. According to the Press Democrat, Herb Schultz, regional director of U.S. Health and Human Services, held a forum in Santa Rosa last year to discuss the impact of the new law. Many local small businesses and nonprofits attended to learn more.

However, some businesses still have questions about the new law. Here is an overview on accounts payable and the ACA.

Do I Need to Worry About Accounts Payable and the ACA in Santa Rosa?

The rules governing the Affordable Care Act are very complex. Due to the ambiguity of the laws, many business owners aren’t even aware if the requirements apply to them. Is your business affected by the Affordable Care Act requirements?

If you have fewer than the equivalent of 50 full-time employees on your payroll, then you will need to purchase insurance or pay a $2,000 fine for the workers it didn’t cover.

For the purposes of the new law, an employee is counted as full-time if they are working 30 hours or more a week. Two part-time employees will be count as the equivalent of a single full-time employee.

The policy can be very confusing for businesses with both full-time and part-time employees on staff. Here are some examples to better understand.

Example 1:

Max just opened a new restaurant on Mendocino Avenue. He hires a full-time manager and assistant manager, two full-time cooks and ten part-time servers.

Under the new guidelines, he would have the equivalent of nine full-time employees (4 full time employees + 10 part-time employees * 0.5), so he would not be affected by the new law.

Example 2:

Eric is starting his own new business consultancy agency on Santa Rosa Avenue. He has hired 40 full-time staff and 30 consultants working 20 hours a week.

Since the 30 part-time employees are counted as 15 full-time workers, the ACA requirements state that he has 55 full-time employees on the payroll.

Therefore, he is legally required to provide health insurance and report it to the IRS.

What Does the Healthcare Law Mean for Accounts Payable and the ACA in Santa Rosa?

A/P Healthcare Law

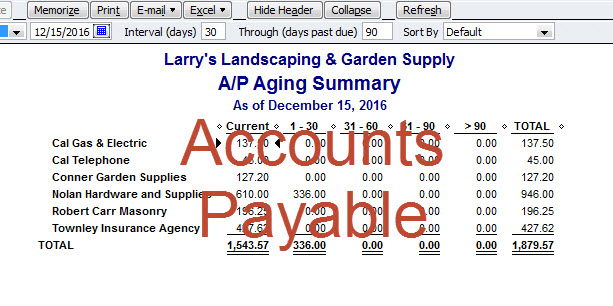

A/P Healthcare LawIf you have 50 or more full-time employees, then you are going to need to purchase health insurance for them or pay the $2,000 fine per employee. Here is an overview of the accounts payable transactions for each option.

Choosing to Pay the Fine

The bookkeeping process is more straightforward if you decide to pay the fine. You will simply calculate the number of employees by $2,000 to determine the penalty.

You will make a debit entry for ACA tax penalty expense and a credit entry for ACA tax penalty payable. If you have 100 full-time employees, then your total penalty will be $200,000, so your double-entry bookkeeping journal entry will look like:

Debit Credit

ACA tax penalty expense $200,000

ACA tax penalty payable $200,000

You will want to make the entry at the beginning of the year if you have already decided not to pay for your employees’ health insurance. After you have paid the penalty, you will need to perform the following entries:

Debit Credit

ACA tax penalty payable $200,000

Cash $200,000

You will still need to file a Section 6056 form to the IRS by February 29, 2016 (or March 31, 2016 if you plan to file electronically).

Choosing to Pay for Health Insurance

If you are going to be paying for your employees’ healthcare, then you will need to make a journal entry each month to reflect the premium.

If you are paying $300 for each of the 100 members in your group plan, then your accounts payable transactions will look like this:

Debit Credit

Health insurance expense $300,000

Health insurance payable $300,000

After the health insurance has been paid, you will close the accounts payable with the following transaction:

Debit Credit

Health insurance payable $300,000

Cash $300,000

Make sure that you make the payments and accounts payable and the ACA in Santa Rosa entries each month.

The payments must be made to the health insurer, not Covered California, even if you purchased your insurance on the Covered California website.

We Can Help You Prepare for the New Healthcare Law

The Affordable Care is one of the most comprehensive laws ever passed in our country. Many small businesses are still struggling to understand its implications.

If you need help with accounts payable and the ACA in Santa Rosa or anwhere else, then please don’t hesitate to contact us. We look forward to assisting you!

Accounts Payable Articles

- Accounts Payable Recording Outstanding Bills

- Accounts Payable and the ACA in Santa Rosa

- Accounts Payable and the Self Employment Tax

- Accounts Payable Journal Entries

- Accounts Payable Journal Entries for IRS Audit

- Accounts Payable Petaluma

- Accounts Payable Santa Rosa

- Accounts Payable Affect Cash Flow

- Accounts Payable In Santa Rosa

- Accounts Payable JE's for Growing Businesses

- Accounts Payable Spreadsheet

- Auditing Accounts Payable

- Bookkeeping Services and Accounts Payable

- Calculating Accounts Payable

- Accounts Payable Journal Entry

- Ideal Accounts Payable Turnover

- Improve Accounts Payable Turnover

- Accounts Payable and Minimum Wage Increases

- Streamlining Accounts Payable

Please subscribe to my monthly newsletter, Bookkeeping Basics E-zine. It tells you every month about the new information that I have added, including some great tips and advice from myself and other Bookkeeping Basics readers.

Like Bookkeeping-Basics.net?

- Home

- Accounts Payable

- A/P And The ACA

New! Comments

Have your say about what you just read! Leave me a comment in the box below.