- Home

- Accounts Payable

- Accounts Payable Santa Rosa

Accounts Payable Santa Rosa

How To Calculate A/P Cycles

Welcome to Accounts Payable Santa Rosa. Do you know these Six Easy Steps to Calculate A/P Cycles? A/P is an accounting term that defines short term payment obligations.

These are payables due on a monthly or quarterly basis. (A/P) are liabilities on a balance sheet. As a business owner, understanding how to calculate the number of accounts payable cycles will explain how long it takes your business to pay its invoices and how many days invoices are outstanding. You should use history from the previous year to determine payment goals for the current year. Below are seven easy steps to calculate the number of accounts payable cycles for your business. You don’t need an accounting background to understand these steps!

Calculating Accounts Payable Santa Rosa - Six Easy Steps

To calculate the average number of days your accounts payable remain outstanding, follow these steps:

Step 1: Record the beginning balance of accounts payable as of January 1st of the prior year.

Step 2: Record the ending balance of accounts payable as of December 31st of the prior year.

Step 3: Add the beginning and ending balances, then divide the sum by 2 to get the average balance.

Step 4: Determine the total purchases made during the year, from January 1st to December 31st, and record this amount.

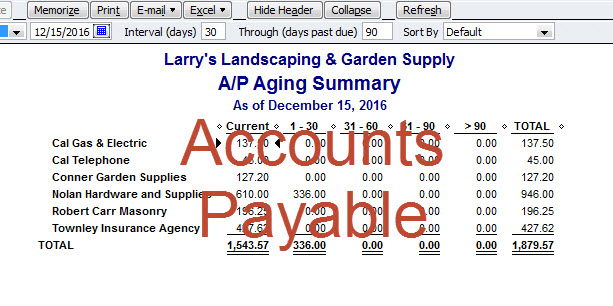

Step 5: Divide the total purchases by the average accounts payable balance calculated in Step 3. The resulting number represents the number of accounts payable cycles for the previous year. This indicates how many times your firm completes a full payment cycle throughout the year.

Step 6: Divide the number of accounts payable cycles obtained in Step 5 by the number of days in a year (365). The result is the average number of days your accounts payable remain outstanding.

For example, if your company's beginning accounts payable balance is $85,925 and the ending balance is $61,935, the total is $147,860. Dividing this by 2 gives an average balance of $73,930.

Next, suppose the total purchases for the last twelve months amount to $689,000. Dividing this by the average balance of $73,930 yields a result of approximately 9.32.

This means that your company experiences just over nine accounts payable cycles in a year. To determine the average number of days, divide 365 by 9.32, resulting in approximately 39 days.

Therefore, based on this calculation, your company's accounts payable typically remain outstanding for about 39 days on average.

By understanding this cycle and the average number of days your accounts payable are outstanding, you can better manage your cash flow and make more informed financial decisions.

Accounts Payable Santa Rosa - Summary

Now that you have learned how to calculate the number of accounts payable cycles and the days outstanding, it's crucial to understand why this information is important for your business and credit. Cash flow plays a significant role, particularly for start-up companies and small businesses. Maintaining sufficient cash on hand is essential, and understanding your accounts payable journal entry cycles helps you effectively manage your cash flow.

By knowing the average number of days your accounts payable remain outstanding, you can negotiate payment terms with suppliers and take advantage of any early payment discounts offered. Timely invoice payments are vital to maintaining good relationships with vendors and preserving your company's ability to obtain credit in the future.

The bottom line is to ensure that you pay your invoices promptly and within the agreed-upon terms. This not only strengthens your financial standing but also promotes trust and reliability in your business dealings.

If you have any questions about our bookkeeping services or need further assistance, please don't hesitate to contact us. We are here to support you and provide professional guidance for all your bookkeeping needs.

Accounts Payable Questions and Answers

We understand that managing accounts payable can sometimes be a complex task, and you may have specific questions or challenges along the way. That's why we offer an Accounts Payable Questions and Answers page to provide you with the support and guidance you need.

On our dedicated page, you will find a compilation of frequently asked questions related to accounts payable. We have carefully curated these questions to address common concerns and provide valuable insights into managing this crucial aspect of your business finances.

Whether you need clarification on accounts payable processes, tips for streamlining your payment workflow, or guidance on resolving common issues, our Accounts Payable Questions and Answers page is a valuable resource. We strive to provide comprehensive and practical information to help you navigate the complexities of accounts payable effectively.

Additionally, our Q&A page is regularly updated with new questions and answers to ensure that you have access to the most relevant and up-to-date information. We aim to address the common pain points and challenges faced by businesses in managing their accounts payable, allowing you to make informed decisions and improve your financial processes.

At Bookkeeping-Basics.net, we are committed to providing you with the knowledge and tools necessary to succeed in your bookkeeping and accounting endeavors. Our Accounts Payable Questions and Answers page is just one of the many resources we offer to support your financial journey.

If you have specific questions or concerns regarding accounts payable in Santa Rosa, we encourage you to visit our page and explore the wealth of information available. And if you can't find the answer you're looking for, please feel free to reach out to our knowledgeable team for personalized assistance. We are here to help you navigate the world of accounts payable and ensure the smooth financial operation of your business structure.

Accounts Payable Articles

- Accounts Payable Recording Outstanding Bills

- Accounts Payable and the ACA in Santa Rosa

- Accounts Payable and the Self Employment Tax

- Accounts Payable Journal Entries

- Accounts Payable Journal Entries for IRS Audit

- Accounts Payable Petaluma

- Accounts Payable Santa Rosa

- Accounts Payable Affect Cash Flow

- Accounts Payable In Santa Rosa

- Accounts Payable JE's for Growing Businesses

- Accounts Payable Spreadsheet

- Auditing Accounts Payable

- Bookkeeping Services and Accounts Payable

- Calculating Accounts Payable

- Accounts Payable Journal Entry

- Ideal Accounts Payable Turnover

- Improve Accounts Payable Turnover

- Accounts Payable and Minimum Wage Increases

- Streamlining Accounts Payable

Please subscribe to my monthly newsletter, Bookkeeping Basics E-zine. It tells you every month about the new information that I have added, including some great tips and advice from myself and other Bookkeeping Basics readers.

Like Bookkeeping-Basics.net?

- Home

- Accounts Payable

- Accounts Payable Santa Rosa

New! Comments

Have your say about what you just read! Leave me a comment in the box below.