- Home

- Accounts Payable

- Ideal Accounts Payable Turnover

Ideal Accounts Payable Turnover

Achieve Optimal Cash Flow

What is the ideal accounts payable turnover? Many companies don’t know or understand the importance of ensuring this important metric in order to achieve optimal cash flow. It is actually a critical variable for managing cash flow, so make sure to review it carefully every quarter.

Every business needs to formulate a strategy for managing cash flow, which requires them to pay close attention to their A/P transactions. The underlying goal is to determine the best time to make payments to creditors to always have sufficient cash on hand. In other words, business owners need to determine their ideal accounts payable turnover - analyze their accounts payable turnover and consider either making payments earlier or delaying them.

What is Accounts Payable Turnover?

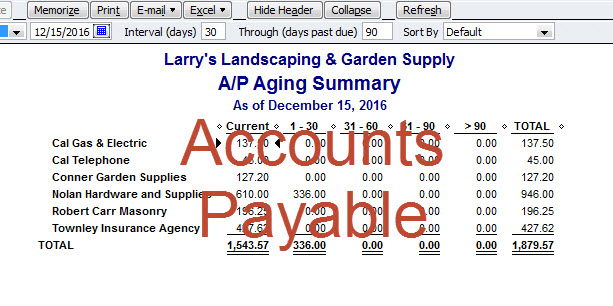

Accounts payable turnover is a financial ratio that assesses the average time it takes for a company to pay off its creditors. The metric is very important for managing cash flow and is calculated with the following formula:

Accounts payable turnover = Total purchases / Average accounts payable balance

The following formulas are used to calculate the total purchases and average accounts payable balance:

Total purchases = Cost of sales + Inventory balance at end of period – Inventory balance at beginning of period

Average accounts payable = (Accounts payable balance at the beginning of period + Accounts payable balance at the end of period)/2

It only takes a few minutes to calculate your accounts payable turnover ratio, provided you are up to date with your bookkeeping. However, analyzing this metric to make more informed cash management decisions is slightly more complicated. The following section provides some important insights.

What Does Your Ideal Accounts Payable Turnover Ratio Mean?

Is it better to increase or decrease your accounts payable turnover ratio? Unfortunately, it is difficult to answer that question, because both approaches could lead to cash flow problems if utilized improperly.

If your accounts payable turnover is too high, then you may be paying bills too quickly and you may not have sufficient cash on hand to meet future bills. However, low accounts payable turnover ratios can indicate that you are delaying your payments too long and may have difficulty raising the cash needed. Here are some factors to consider when paying accounts payable:

- Supplier discounts. Many suppliers offer discounts to customers for early payments. For example, a supplier may offer terms of 2/10, which indicates that customers receive a 2% discount for payments made within 10 days of receipt of the goods or services. If the company takes an average of 11 or more days to make payments, then it may be missing some valuable discounts.

- Cost of borrowing cash. Borrowing cash will be expensive if your lender charges high interest rates for short-term loans. It is best to avoid borrowing cash except for emergencies.

- Accounts receivable cycles. Your accounts receivable cycles also play an important role in managing your accounts payable. Companies that receive payments infrequently may need to extend their accounts payable turnover ratio to ensure they have enough cash on hand to deal with unexpected expenses that may arise.

- Relationship with suppliers. Maintaining good relationships with suppliers is an important priority for most businesses. A high accounts payable turnover ratio may indicate that you are either late making payments or paying them as close to the due date as possible. Your suppliers probably won’t be upset if you wait until the last minute to receive payment, but they will appreciate early payments. Some suppliers offer more favorable terms to customers that regularly make payments early, so keep this in mind while analyzing your accounts payable turnover rate.

Accounts receivable accounting cycles and supplier contracts vary by industry, so it is impossible to determine the best accounts payable turnover. However, it is important to study the metric within the context of your own business. After using this metric to perform a cost-benefit analysis, you may decide to start paying your bills earlier or later.

If you need help to determine the ideal accounts payable turnover for your business, please do not hesitate to ask us.

Ideal A/P Turnover Summary

The ideal accounts payable turnover refers to achieving an optimal balance between efficiency and cash flow management in the payment cycle. It involves streamlining invoice processing, negotiating favorable payment terms, implementing robust cash flow forecasting, optimizing payment scheduling, and fostering strong vendor relationships.

By monitoring accounts payable aging, embracing technology solutions, improving cash management practices, strengthening internal controls, and enhancing communication, businesses can achieve the ideal accounts payable turnover. This leads to improved efficiency, reduced financial risks, and smoother interactions with vendors and creditors. Ultimately, maintaining an ideal accounts payable turnover ensures a healthy cash flow and contributes to overall financial success.

Accounts Payable Articles

- Accounts Payable Recording Outstanding Bills

- Accounts Payable and the ACA in Santa Rosa

- Accounts Payable and the Self Employment Tax

- Accounts Payable Journal Entries

- Accounts Payable Journal Entries for IRS Audit

- Accounts Payable Petaluma

- Accounts Payable Santa Rosa

- Accounts Payable Affect Cash Flow

- Accounts Payable In Santa Rosa

- Accounts Payable JE's for Growing Businesses

- Accounts Payable Spreadsheet

- Auditing Accounts Payable

- Bookkeeping Services and Accounts Payable

- Calculating Accounts Payable

- Accounts Payable Journal Entry

- Ideal Accounts Payable Turnover

- Improve Accounts Payable Turnover

- Accounts Payable and Minimum Wage Increases

- Streamlining Accounts Payable

Please subscribe to my monthly newsletter, Bookkeeping Basics E-zine. It tells you every month about the new information that I have added, including some great tips and advice from myself and other Bookkeeping Basics readers.

Like Bookkeeping-Basics.net?

- Home

- Accounts Payable

- Ideal Accounts Payable Turnover

New! Comments

Have your say about what you just read! Leave me a comment in the box below.