- Home

- Bookkeeping 101

Bookkeeping 101

Increase Your Knowledge of Bookkeeping

Welcome to the bookkeeping 101 page that will help increase your knowledge of bookkeeping and accounting.

Bookkeeping 101, Increase your knowledge of bookkeeping will give you more than just the bookkeeping basics. It will help teach you about many bookkeeping and accounting topics from setting up a chart of accounts to preparing your profit & loss statement.

You can start learning right away by clicking on any one of the links below, or you can receive the complete accounting series in a convenient and affordable Bookkeeping 101 E-Book.

Bookkeeping 101 E-Book

This Bookkeeping 101 EBook is a useful tool for business owners, bookkeepers, accountants and anyone responsible for household personal finances.

You can receive the complete Bookkeeping 101 accounting series in a 23 page E-Book for $4.97 along with all sorts of other accounting, business and financial goodies.

Bookkeeping 101 Paperback Book

Get a FREE Kindle copy of Bookkeeping 101 For Business Professionals when you purchase the physical paperback book for $14.97 at Amazon.

Bookkeeping 101 For Business Professionals: Increase Your Accounting Skills And Create More Financial Stability And WealthBookkeeping 101 - Preview

Now you can see a preview of my e-book! Take a peek below..

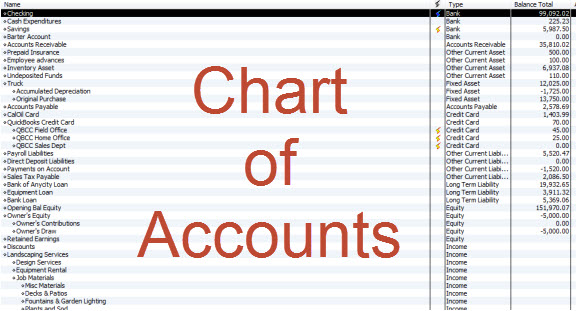

Chart Of Accounts

The chart of accounts is the foundation of your bookkeeping system, so it is very important to have a good understanding of how it works. This is a great place to get started on your learning adventure.

You can think of it like it's a file cabinet full of files, and each file will store a different kind of bookkeeping information. So, if you have bookkeeping information for telephone payments made for your business phone line, you will set up a file (an account) for Telephone Expense.

There are many different kinds of accounts that should be included in your Chart of Accounts.

Learn more about the Chart of Accounts

See the Accounting Chart of Accounts video tutorial

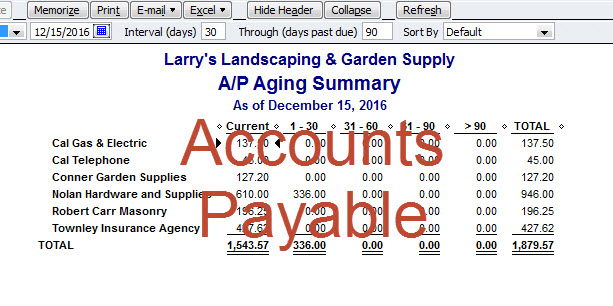

Accounts Payable

The accounts payable account is used to record the bills of a business that are outstanding and is also referred to as A/P which is Accounts Payable for short.

This is a bookkeeping 101 account that should be added to your chart of accounts by the first time you enter a bill. The account will be used to track the money that your business owes to others.

When you pay off your outstanding bills, or when you enter a new bill, you should enter the transaction in the register for your A/P account.

This account is listed in the Chart of accounts as "Accounts Payable." But if you really feel you need to use more than one of this type of account in your business, then you can add additional A/P accounts to the chart or accounts.

Learn more about Accounts Payable

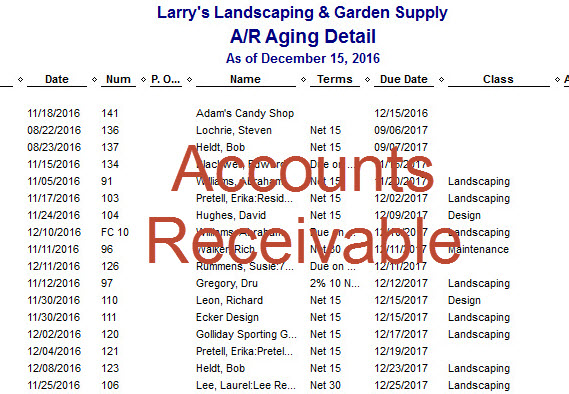

Accounts Receivable

Accounts receivable is the term that bookkeepers and accountants use to refer to the outstanding money that is owed to you for sales that you have already made that haven't been paid for yet.

This is another bookkeeping 101 account that should be added to your chart of accounts by the first time you write an invoice. The account will be used to track the money that is owed to your business.

When you receive a payment from a customer, or when you write an invoice, you should enter the transaction in the register for your A/R account.

This account is listed in your chart of accounts as "Accounts Receivable." But if you really need to use more than one of this type of account in your business, then you can add additional A/R accounts to the chart of accounts as well.

Learn more about Accounts Receivable

Bank Reconciliation

Bank reconciliation is a necessary monthly bookkeeping task. QuickBooks makes it easier than ever with a quick and simple process that you can learn right here.

You will first select the QuickBooks accounting software file in which you will be working. Then, select the account to be reconciled.

The beginning balance will be zero for a new account, or it will be carried over from a previous reconciliation.

Alternatively, if this is the first month you are using QuickBooks, it was entered when you set up the chart of accounts.

Learn More About Bank Reconciliations

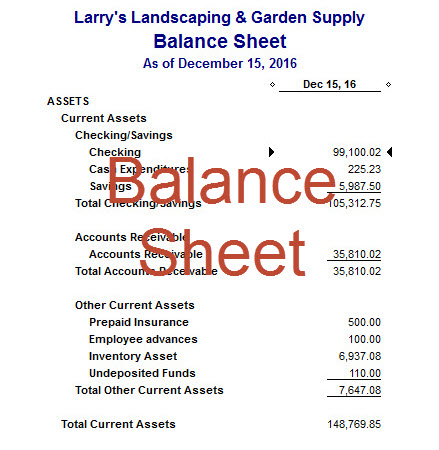

Balance Sheet

The balance sheet is a report that gives you a summary of the financial situation of a business on any given date. It will show you the value of your company's assets, liabilities, and equity. Click on the balance sheet link to learn more about this important financial tool.

There are many different bookkeeping accounts that appear on the report. The different bookkeeping accounts you will find can be thought of as all of the things (including money) that you own and the debts that you owe.

This would include things like bank accounts, property (buildings), equipment, furniture and amounts that people owe you (Accounts Receivable). This also includes all of your liabilities such as bank loans, credit cards, and amounts you owe to other people (Accounts Payable).

Learn more about the Balance Sheet

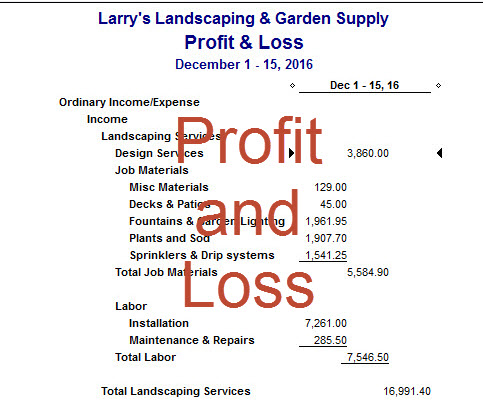

Profit And Loss Statement

If you are like most new business owners just starting their business, you don't know how to read financial statements. And that can be detrimental to your success. But your business is going to be a success! Why?...

Because you are already here ready, able and willing to learn how to read and use the profit & loss statement (otherwise known as an income statement)

Learn more about the Profit and Loss Statement

Bookkeeping Tutorial

These bookkeeping tutorials and bookkeeping courses are basic free accounting tutorials that will teach and visually show you by video how to do all the different aspects of bookkeeping.

Each of the basic tutorials are presented as a written article outlining how to perform a bookkeeping or accounting function.

See the Bookkeeping Basics Bookkeeping Tutorial

Learn about other Bookkeeping Tutorials

More Bookkeeping 101

- Accounts Payable

- Accounts Receivable

- Balance Sheet

- Bank Reconciliation

- Chart of Accounts

- Profit and Loss Statement

Please subscribe to my monthly newsletter, Bookkeeping Basics E-zine. It tells you every month about the new information that I have added, including some great tips and advice from myself and other Bookkeeping Basics readers.

Like Bookkeeping-Basics.net?

- Home

- Bookkeeping 101

New! Comments

Have your say about what you just read! Leave me a comment in the box below.