- Home

- Accounts Payable

- A/P Cash Flow

How Does Accounts Payable Affect Cash Flow?

Understanding The Relationship

One of the questions we frequently receive is: How does accounts payable affect cash flow in the short, medium and long term?

Financial health is important to any business. There are certain aspects that cannot be neglected. A/P management is one of them.

If you are not on top of your accounts payable and the impact it has on your finances, severe consequences can result. Some of these issues could be:

Accounts Payable Affect Cash Flow - Outstanding Bills

Accurate and Timely Payment: A key aspect of managing accounts payable is understanding your financial obligations and ensuring timely payment. Failing to have a clear understanding of what needs to be paid and when can result in missed payment deadlines and delinquent bills. This not only affects your relationships with suppliers and vendors but also tarnishes your reputation as a responsible business owner.

Preserving Credibility: When bills are consistently paid late, it can lead to a loss of credibility and trustworthiness in the eyes of your suppliers, vendors, and business partners. This can have long-term consequences as it may impact your ability to negotiate favorable terms, secure credit, or establish mutually beneficial relationships.

Enhancing Financial Standing: By effectively managing accounts payable, you demonstrate your commitment to financial responsibility. This can positively influence your creditworthiness and increase your chances of securing loans or lines of credit when needed. Lenders and financial business planning institutions value businesses that exhibit a strong track record of timely payments and sound financial management practices.

Maintaining Positive Business Relationships: Prompt payment of bills establishes a positive rapport with your suppliers and vendors. It fosters strong business relationships built on trust and reliability, leading to potential benefits such as discounts, preferential treatment, and improved customer service.

Proactive Financial Management: Managing accounts payable allows you to stay on top of your financial obligations, preventing unnecessary penalties, late fees, and legal disputes. It provides you with a clear overview of your financial position, enabling better decision-making and effective cash flow management.

By prioritizing the management of accounts payable journal entries and ensuring timely payment, you can maintain a strong financial standing, uphold your credibility as a business owner, and foster positive relationships with your suppliers and vendors.

Accounts Payable Affect Cash Flow - Lines of credit

Accounts payable serves as a crucial tool for tracking your credit lines with vendors for essential supplies and services. Failing to effectively manage these obligations and accumulating excessive credit due on a monthly basis can restrict your cash flow and hinder financial stability.

Accounts payable encompasses various financial documents, including purchase orders, invoices, contracts, and reports associated with outstanding debts. It is important to recognize that accounts payable directly influences your cash flow. Failure to maintain a disciplined approach to managing accounts payable can lead to cash flow constraints and financial difficulties.

By diligently monitoring and managing your accounts payable, you can optimize your cash flow and ensure timely payment of your financial obligations. This proactive approach allows you to maintain a healthy financial position, foster positive relationships with vendors, and mitigate the risk of cash flow restrictions.

Effectively managing accounts payable involves establishing clear payment terms, closely monitoring payment deadlines, and maintaining accurate records of outstanding debts. By doing so, you can maintain a positive cash flow, enhance your financial stability, and cultivate a reputation as a reliable and responsible business owner.

Remember, staying on top of your accounts payable is vital for ensuring a healthy cash flow and maintaining strong relationships with vendors and suppliers. By prioritizing effective accounts payable management, you can optimize your financial operations and set your business up for long-term success.

A/P Affect Cash Flow - Inventory

Your inventory will suffer when you don’t have the ability to acquire goods you need due to a negative cash flow as a result of outstanding bills.

When situations like this occur in your accounts payable, your cash flow is severely affected. Why?

The accounts payable line item usually has a credit balance based on the invoices being recorded. Accounts Payable gives you a running account of the amount of money you owe to your creditors.

As long as you have money owed, it decreases your cash flow. Accounts Payable is considered a liability. As you acquire credit, payments on a recurring basis reduce your cash flow significantly.

If you do not have a good handle on this and keep opening new accounts, your monthly deductible expenses will use up all the working capital you may have.

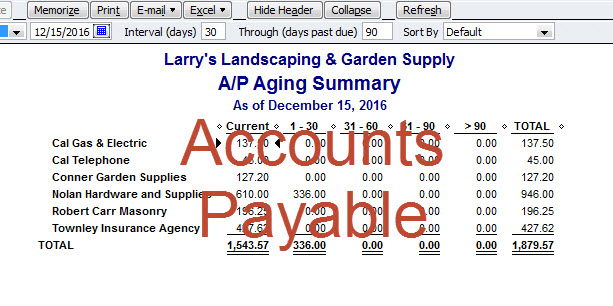

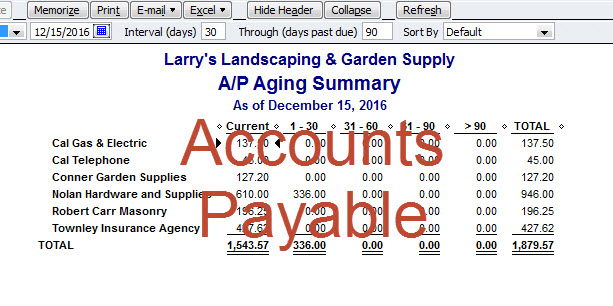

Accounts Payable Spreadsheet

The accounts payable spreadsheet is one of the most important documents you can have to see a real-time snapshot of where your money is going.

Any good business owner will know the intricacies of the accounts payable spreadsheet thoroughly, even if you have an accountant or bookkeeper on hand.

Being able to understand how things work and how your cash flow will be affected is a major responsibility of a business owner.

Debits and credits should be familiar financial jargon to keep your books in order and running smoothly.

Taking the time to understand how accounts payable works and how it can affect your cash flow will be beneficial to the longevity of your business.

Taking a class or bookkeeping tutorial to become better acquainted with the system will be well worth the time and effort.

Accounts Payable Articles

- Accounts Payable Recording Outstanding Bills

- Accounts Payable and the ACA in Santa Rosa

- Accounts Payable and the Self Employment Tax

- Accounts Payable Journal Entries

- Accounts Payable Journal Entries for IRS Audit

- Accounts Payable Petaluma

- Accounts Payable Santa Rosa

- Accounts Payable Affect Cash Flow

- Accounts Payable In Santa Rosa

- Accounts Payable JE's for Growing Businesses

- Accounts Payable Spreadsheet

- Auditing Accounts Payable

- Bookkeeping Services and Accounts Payable

- Calculating Accounts Payable

- Accounts Payable Journal Entry

- Ideal Accounts Payable Turnover

- Improve Accounts Payable Turnover

- Accounts Payable and Minimum Wage Increases

- Streamlining Accounts Payable

Please subscribe to my monthly newsletter, Bookkeeping Basics E-zine. It tells you every month about the new information that I have added, including some great tips and advice from myself and other Bookkeeping Basics readers.

Like Bookkeeping-Basics.net?

- Home

- Accounts Payable

- A/P Cash Flow

New! Comments

Have your say about what you just read! Leave me a comment in the box below.