- Home

- Bitcoin 101

- Accounts Payable

Accounts Payable

Recording Outstanding Bills & Vendor Invoices

The accounts payable account is used to record the bills of a business that are outstanding and is also referred to as A/P for short.

There usually is only one single account on the chart of accounts to track all of the outstanding bills even though the word accounts is plural.

This is an account that should be added to your chart of accounts by the first time you enter a bill. The account will be used to track the money that your business owes to others.

Bookkeeping 101 E-Book

This Bookkeeping 101 EBook is a useful tool for business owners, bookkeepers, accountants and anyone responsible for household personal finances.

You can receive the complete Bookkeeping 101 accounting series in a 23 page E-Book for $4.97 along with all sorts of other accounting, business and financial goodies.

Accounts Payable

When you pay off your outstanding bills, or when you enter a new bill, you should enter the transaction in the register for your A/P account.

This account is listed in the Chart of accounts as "Accounts Payable." But if you really feel you need to use more than one of this type of account in your business, then you can add additional A/P accounts to the chart or accounts.

Entering Open Vendor Account Balance

For each vendor that you have, you will need to enter the amount owed to you on your start date. If you do not know the opening balance, you can just choose a different start date starting from when you do know the opening balance.

Or you can figure out the bookkeeping 101 opening balance by reconstructing what you owe your vendor today and reconstruct what you owed them at your start date by subtracting any payments you made between then and now and adding any additional billings you have received between then and now.

You can also ask your accountant for the year-to-date balances for your accounts.

When you enter the opening balance for your vendors, you're building the A/P opening balance.

From Your Start Date Up To Today's Date

When you enter the following types of transactions using the standard sales forms (checks, bills and invoices) you are ensuring that your A/P accounts (and accounts receivable and income and expense statement) are up-to-date and accurate:

- Bill payments

- Bills from vendors

- Credits from vendors

- Deposits Ledger

- Sales tax payments

- Invoices and sales receipts with sales tax, if appropriate

- Customer returns

- Payments received from customers

A/P Register

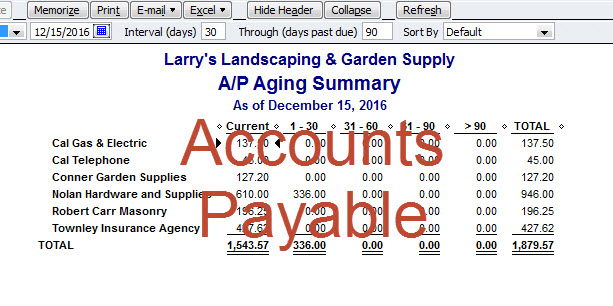

The A/P register will list all of the payments, credits, and bills related to each of your individual vendors.

New bills can typically be entered directly into the register or through an enter bills tab in most bookkeeping software.

Following is a sample accounts payable summary register:

Different Ways To Pay For Your Bills

There are two different ways that you can manage bill payments in most bookkeeping software.

You can enter bills when you get them and pay them when they're due.

Using his method will let you keep your money in your business for as long as possible and stay on top of how your accounts payable affect cash flow. It will also enable you to track how much money you owe to others. You can then run reports at any time to see how much money you owe to others, and to whom you owe it.

This is a good method to use to keep a record of all your bills, both before and after they're paid. You can simply use the Enter Bills window to enter bills into your A/P account and use the Pay Bills window to pay them when they're due.

You can also set up most bookkeeping software to remind you to pay bills when they're due.

Important: When you enter a bill in the Enter Bills window, you should always use the Pay Bills window to pay that bill as well. If you don't the bill will not be marked as paid.

You can pay bills as soon as you receive them.

You should use this method only when the bills have not been entered and you don't really need to track them.

When you pay with check, cash, or any other form of payment other than a credit card, you can use the Write Checks window.

When you pay a bill with a credit card, you should record the payment in the Enter Credit Card Charges window.

In either window, you can assign the charge to an expense account.

A/P Video Tutorial

View the A/P tutorial playlist below. This is a three part video series on how to do Accounts Payable in QuickBooks.

- A/P Introduction

- How To Do A/P In QuickBooks Part 1

- How To Do A/P In QuickBooks Part 2

TRANSCRIBED: Hello, I'm Stephanie Horne from Bookkeeping Basics. I'm a bookkeeper and focus on professional bookkeeping services for small to medium-sized businesses. Today I will be discussing Accounts Payable.

So first of all, what is A/P? The accounts payable is the account that is used to record the bills of a business that are outstanding and is also referred to as A/P for short.

This is an account that should be added to your chart of accounts by the first time you enter a bill in order to properly track the money that your business owes to others.

When you enter a new bill, or you pay off your outstanding bills, you should enter the transaction in the spreadsheet register for your A/P account.

This process may or may not start with the generation of a purchase order when you purchase something from a vendor.

After making the purchase you would then receive a bill from your vendor that you would enter into A/P so that you will be able to generate a report showing how much you owe, to who and when it's due.

Then, you would eventually pay the bill so that it would not show up in A/P.

It is important to use the Accounts Payable account properly in order to generate correct reports and be able to stay on top of cash flow. QuickBooks Accounting Software makes paying and tracking bills using the a/p account nice and easy.

Please come back next week and I will go over exactly how to do A/P in Quickbooks. Thank you!

Have A Question About The Accounts Payable Account?

Do you have a question about this? Please ask it!

What Other Visitors Have Said

Click below to see contributions from other visitors to this page...

What Is The Accounts Payable - Demystifying A/P

How do you remove an account payable with a balance from a computer program? This account was entered in a business account. However, it is a personal …

More Bookkeeping 101

- Accounts Payable

- Accounts Receivable

- Balance Sheet

- Bank Reconciliation

- Chart of Accounts

- Profit and Loss Statement

More Accounts Payable

- Accounts Payable Recording Outstanding Bills

- Accounts Payable and the ACA in Santa Rosa

- Accounts Payable and the Self Employment Tax

- Accounts Payable Journal Entries

- Accounts Payable Journal Entries for IRS Audit

- Accounts Payable Petaluma

- Accounts Payable Santa Rosa

- Accounts Payable Affect Cash Flow

- Accounts Payable In Santa Rosa

- Accounts Payable JE's for Growing Businesses

- Accounts Payable Spreadsheet

- Auditing Accounts Payable

- Bookkeeping Services and Accounts Payable

- Calculating Accounts Payable

- Accounts Payable Journal Entry

- Ideal Accounts Payable Turnover

- Improve Accounts Payable Turnover

- Accounts Payable and Minimum Wage Increases

- Streamlining Accounts Payable

Please subscribe to my monthly newsletter, Bookkeeping Basics E-zine. It tells you every month about the new information that I have added, including some great tips and advice from myself and other Bookkeeping Basics readers.

Like Bookkeeping-Basics.net?

- Home

- Bitcoin 101

- Accounts Payable

- Home

- Bookkeeping 101

- Accounts Payable

New! Comments

Have your say about what you just read! Leave me a comment in the box below.