- Home

- Accounts Payable

- Accounts Payable in Santa Rosa

Accounts Payable in Santa Rosa

9 Steps To Reconcile A/P

Accounts Payable in Santa Rosa - 9 Essential Steps to Reconcile A/P. Whether accounting is your mainstay or you're just getting started with your new business here in Santa Rosa, reconciling your cash flow balance is a very important part of your organization’s financial business cycle.

Knowing the accuracy of your entries is crucial for understanding your business's financial health and true value. Gain insights and guidance on verifying the accuracy of your A/P entries. Discover best practices for reconciling accounts, identifying errors, and ensuring the integrity of your financial records. By leveraging the expertise and resources available on this page, you can confidently assess the accuracy of your accounts payable and make informed financial decisions for your business.

Reconciling your accounts payable ledger balance against your general ledger's accounts payable account helps to catch errors quickly and efficiently, provided that it is done on a regular basis. Though it may sound like a difficult process, reconciling your A/P bookkeeping ledger against your general ledger can actually be a simple and straightforward process. Here's how:

The 9 Essential Steps to Reconcile Your Accounts Payable in Santa Rosa

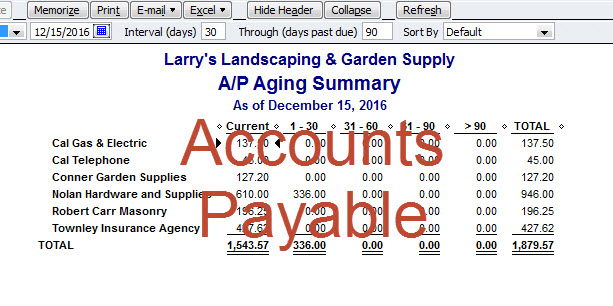

- Take a look at the balances from the end of your last reporting period in your general ledger's accounts payable account against the aged accounts payable detail report from the same time period. If they don't match, you'll need to go through the following process for earlier reporting periods until you get to one that matches and therefore doesn't need to be reconciled. If you do need to go back, just remember that once it's caught up, you'll only need to do one reporting period at a time, making the job go more smoothly and easily next time.

- Look at the accounts payable in Santa Rosa account in the general ledger to see if there are any journal entries that were made during the reporting period you're working on. If there are, be sure to record them on your reconciling spreadsheet.

- Print a copy of the aged accounts payable report for the reporting period you're reconciling. On the bank reconciliation spreadsheet for that reporting period, enter the total amount that is outstanding from that report. This should make the amounts match. If not, proceed to the next step.

- If you have a discrepancy, there are three areas where it can occur. Take the time to verify whether the information is correct in the next three steps to find where the error is occurring. Once you've found it and verified that the other areas are correct, you've eliminated the areas where the error could have occurred and will know where to look.

- Check that the proper figure was copied to the general ledger from the accounts payable journal.

- Make sure that all posting was completed before the aged accounts payable report was printed.

- Verify that the general ledger is set to the appropriate reporting period. If it's pulling information from outside this period, the balances will be skewed with information from other reporting periods.

- After checking this information, make any adjustments that are necessary to correct any errors on the reports you're using.

- Now that you've completed any necessary adjustments, run your general ledger's accounts payable account and accounts payable ledger balances again. They should match at this point. If not, repeat steps 5 through 9 again to find the discrepancy.

Remember, the first time you are reconciling the accounts is always the most difficult, because you need to practice a relatively new skill or use a new system and correct any errors in it. After it's been straightened out, it's much easier to simply update and verify your balances to get the correct figures on a regular basis.

How often you want to do this depends on how much business you do, how often you have accounts payable entries posted to the accounts and how up to date you need your business' data to be. By maintaining your accounting records, it's easy to come up with reports on your business' liabilities and an accurate financial outlook for it.

If you are a local business owner here needing accounts payable in Santa Rosa and balancing your accounts payable still feels to much of a challenge, please do not hesitate to contact me for outsourced bookkeeping services, I will be happy to assist you.

Accounts Payable Questions and Answers

The Accounts Payable Questions and Answers page is a valuable resource that provides expert guidance and practical solutions for managing accounts payable. It covers a wide range of topics such as invoice management, vendor payments, and reconciliation. Users can find answers to commonly asked questions and seek tailored advice for their specific situations.

With the help of this page, you can enhance your business financial planning and understanding of accounts payable concepts, streamline processes, and ensure compliance. Take advantage of this resource to optimize your accounts payable management and benefit from the expertise of the Bookkeeping-Basics.net team.

Accounts Payable Articles

- Accounts Payable Recording Outstanding Bills

- Accounts Payable and the ACA in Santa Rosa

- Accounts Payable and the Self Employment Tax

- Accounts Payable Journal Entries

- Accounts Payable Journal Entries for IRS Audit

- Accounts Payable Petaluma

- Accounts Payable Santa Rosa

- Accounts Payable Affect Cash Flow

- Accounts Payable In Santa Rosa

- Accounts Payable JE's for Growing Businesses

- Accounts Payable Spreadsheet

- Auditing Accounts Payable

- Bookkeeping Services and Accounts Payable

- Calculating Accounts Payable

- Accounts Payable Journal Entry

- Ideal Accounts Payable Turnover

- Improve Accounts Payable Turnover

- Accounts Payable and Minimum Wage Increases

- Streamlining Accounts Payable

Please subscribe to my monthly newsletter, Bookkeeping Basics E-zine. It tells you every month about the new information that I have added, including some great tips and advice from myself and other Bookkeeping Basics readers.

Like Bookkeeping-Basics.net?

- Home

- Accounts Payable

- Accounts Payable in Santa Rosa

New! Comments

Have your say about what you just read! Leave me a comment in the box below.