- Home

- Accounts Payable

- Accounts Payable Journal Entry

Accounts Payable Journal Entry

Managing Your Financial Records

Welcome to my Accounts Payable Journal Entry page. Can you do with a few tips to ensure your A/P process helps you to pay your bills on time and enjoy accurate financial records?

Tracking the transactions of money that you owe to vendors can be considered a boring part of the job, but it is a very important part of running a business. You need to keep make a journal entry for every bill. Here are some tips to maintain accurate A/P records.

Accounts Payable Journal Entry Basics

In order to properly record accounts payable, you need to understand the fundamental rule of accounting used for GAAP bookkeeping purposes. This simple equation is:

Assets = Liabilities + Equity

All bookkeeping journal entries rely on this equation. You will need to make a debit and a credit in every entry to reflect the value being adjusted. The following table provides an overview of the basics of debits and credits.

Debit Credit

Asset Increase Decrease

Liability Decrease Increase

Income/Revenue Decrease Increase

Expense Increase Decrease

Equity/Capital Decrease Increase

To make an accounts payable journal entry, you will add a debit for the asset being purchased and a credit for the accounts payable. For example, let’s assume that you purchased a computer worth $5,000 on credit. You would need to make the following journal entry:

Account Debit Credit

Computer 5,000

Accounts payable 5,000

You will eventually need to pay the bill. Here is the journal entry that you will use:

Account Debit Credit

Accounts payable 5,000

Cash 5,000

The process of recording a single entry is very straightforward. The challenge is keeping track of all the purchases that you make on a regular basis. You will need to develop a system to organize your bills and purchases. You also need to check your bookkeeping ledger records regularly to ensure all entries are properly recorded.

Accounts Payable Journal Entry - Keep Records of All Invoices

It is a good idea to maintain copies of all invoices for proper bookkeeping services practices. Even the most diligent business owners can make mistakes when recording accounts payable journal entries. Periodically cross-referencing your journal entries with the corresponding invoices can help ensure accuracy in your financial records.

While it is not necessary to keep physical copies of the original invoices, you can opt to capture electronic copies by taking pictures and storing them on your computer or hard drive. Having a record, whether physical or electronic, allows you to detect any bookkeeping errors and rectify them promptly.

Record Accounts Payable Every Day

Professional Services Invoice

Professional Services InvoiceAs a business owner, you encounter numerous challenges in running your company. While it's easy to prioritize other aspects of your business, it's crucial not to overlook the importance of recording accounts payable. Neglecting to record your liabilities and invoices on a daily basis can lead to falling behind and facing unnecessary difficulties.

To stay on top of your accounts payable, make it a habit to keep detailed records of all bills, payroll and invoices throughout the day. By consistently recording them, you minimize the risk of falling behind on payments, overdrawing your accounts, or inaccurately reporting your taxes. This disciplined approach ensures better financial management and helps maintain the smooth operation of your business.

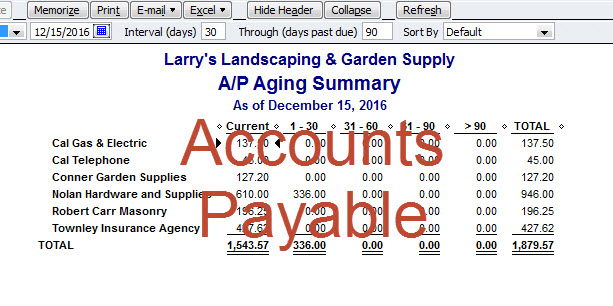

Use Electronic Bookkeeping Software

There are several excellent accounting programs available in the market, such as QuickBooks Accounting Software, FreshBooks, and Wave Accounting, which offer numerous advantages to businesses:

- Electronic Record Backup: These programs allow you to securely store and back up your financial records, ensuring their safety and accessibility whenever needed.

- Efficient Data Organization: Unlike traditional ledgers, accounting software enables easy search and organization of data, saving time and effort in locating specific information.

- Flexibility for Corrections: With bookkeeping software, you can quickly update or edit records in case of bookkeeping mistakes, providing greater accuracy and allowing for timely adjustments.

If you're new to these applications, consulting with a professional accountant or bookkeeper can be beneficial. However, it's important to maintain comprehensive records of accounts payable transactions before seeking their assistance.

If managing accounts payable seems overwhelming, our bookkeeping services are available to support you. We are dedicated to working with you and ensuring your financial records are accurate and well-maintained.

A/P Journal Entry

The Accounts Payable Journal Entry page is a comprehensive resource that guides you through the process of recording accounts payable transactions accurately. It provides step-by-step instructions on how to create journal entries for accounts payable, ensuring proper documentation and organization of financial records. Understanding the journal entry process is crucial for maintaining accurate books and managing your business's financial health.

This page covers various aspects of accounts payable journal entries, including the importance of retaining copies of invoices for error verification. It emphasizes the significance of timely recording and crosschecking journal entries against invoices to avoid errors and discrepancies. Additionally, the page highlights the benefits of using accounting software, such as QuickBooks, FreshBooks, or Wave Accounting, to streamline accounts payable management.

Whether you're a business owner, bookkeeper, or accountant, the Accounts Payable Journal Entry page offers valuable insights and practical guidance to ensure the accuracy and integrity of your accounts payable records. By following the guidelines provided, you can enhance your bookkeeping practices, maintain strong financial control, and effectively manage your payables.

Accounts Payable Articles

- Accounts Payable Recording Outstanding Bills

- Accounts Payable and the ACA in Santa Rosa

- Accounts Payable and the Self Employment Tax

- Accounts Payable Journal Entries

- Accounts Payable Journal Entries for IRS Audit

- Accounts Payable Petaluma

- Accounts Payable Santa Rosa

- Accounts Payable Affect Cash Flow

- Accounts Payable In Santa Rosa

- Accounts Payable JE's for Growing Businesses

- Accounts Payable Spreadsheet

- Auditing Accounts Payable

- Bookkeeping Services and Accounts Payable

- Calculating Accounts Payable

- Accounts Payable Journal Entry

- Ideal Accounts Payable Turnover

- Improve Accounts Payable Turnover

- Accounts Payable and Minimum Wage Increases

- Streamlining Accounts Payable

Please subscribe to my monthly newsletter, Bookkeeping Basics E-zine. It tells you every month about the new information that I have added, including some great tips and advice from myself and other Bookkeeping Basics readers.

Like Bookkeeping-Basics.net?

- Home

- Accounts Payable

- Accounts Payable Journal Entry

New! Comments

Have your say about what you just read! Leave me a comment in the box below.