- Home

- Accounts Payable

- Improve Accounts Payable Turnover

Improve Accounts Payable Turnover

Strategies for Boosting Efficiency

Improve accounts payable turnover ratio... As a business owner, do you really need to improve your accounts payable turnover ratio? Yes, you do!

Accounts

payable turnover is one of the most important efficiency ratios. You should

assess it carefully and follow these tips to reduce or extend payment cycles if

necessary.

Managing accounts payable cycles is essential to manage cash and improve relationships with creditors. Some companies pay their creditors too quickly, which leaves them with insufficient cash to cover future bills. Other companies damage relationships with their vendors and miss important discounts by unnecessarily delaying payments. Savvy businesses monitor their accounts payable turnover ratio and manage their cash accordingly.

Improve Accounts Payable Turnover

You will need to monitor your accounts payable turnover ratio to identify any problems with cash flow management. Here are some tips to follow if payment schedules need to be adjusted.

Outsource Payment Processing

Every business owner have many different responsibilities, which often forces them to postpone certain activities. They often lose track of certain obligations, such as paying creditors. Outsourcing your payment processing makes it easy to stay on track and avoid late payment fees and disgruntled contractors from calling. According to a report from Wells Fargo, one company hired a payment processing company to drastically improve efficiency of accounts payables and free employees that were dedicating entire days to it.

Take a look at your accounts payable turnover period. If the turnover is about the same as the timeframe your creditors expect, then you are probably making some late payments. Working with a respected payment processing provider can reduce the turnover rate considerably. It is a good idea to consider this option if you are overwhelmed and your accounts payable turnover is over 90% of most creditors’ expectations.

Inquire About Automated Payments

Automating payments is another useful strategy to avoid falling behind and to improve accounts payable turnover. Many providers are happy to set up automated withdrawals to ensure they get their money more quickly. Some will also offer discounts for using cards, so it is a good idea to inquire about those as well.

Decide what accounts payable turnover is ideal and try to set up automated payments accordingly. For most businesses, 30 days is an appropriate turnover period, so consider paying your account balance at the same time every month.

Budget Carefully for Seasonal Changes

Many new businesses aren’t prepared for seasonal sales fluctuations. For example, many retailers generate about 25-30% of their sales during the holiday season. Many new storeowners may launch their businesses during the winter and subsequently overestimate the sales they will generate throughout the rest of the year. They may neglect to keep adequate cash reserves to pay their creditors after sales decline.

It is important to pay close attention to seasonal sales trends. If you are new to business, study industry sales patterns to forecast the amount of money you need to set aside.

Use Best Payment Types for Each Supplier

You will also need to consider matching payment options to suppliers. Some suppliers accept credit cards, while others require payments to be made by check. Using timelier electronic payments will make it easier to manage cash flow. These systems also prevent suppliers from needing to take out temporary loans to cover their own expenses while waiting for accounts receivables to be paid, so they may be inclined to extend payment timeframes slightly for customers that use them.

Manage Accounts Payable Turnover Carefully

Maximizing Accounts Payable Turnover: Enhancing Cash Flow Management and Mitigating Financial Challenges

Efficiently managing accounts payable turnover is a crucial aspect of maintaining a healthy cash flow. Whether your turnover seems excessively high or disappointingly low, taking proactive steps to address the issue is essential. By implementing the strategies outlined below, you can optimize your accounts payable turnover and mitigate potential cash shortages, creditor conflicts, and other financial complications.

Streamline Invoice Processing: Evaluate your current invoice processing procedures and identify areas for improvement. Implementing automation tools or adopting electronic invoicing systems can expedite the payment cycle, reduce errors, and enhance overall efficiency.

Negotiate Favorable Payment Terms: Engage in open discussions with your vendors and suppliers to negotiate favorable payment terms. Extending payment deadlines or requesting early payment discounts can positively impact your cash flow and strengthen your working relationship with key business partners.

Enhance Cash Flow Forecasting: Develop a robust cash flow forecasting system to gain insights into future payment obligations and anticipated inflows. Accurate forecasting enables proactive planning, helping you allocate funds effectively and avoid potential liquidity gaps.

Optimize Payment Scheduling: Strategically time your accounts payable payments to align with your cash flow patterns. By coordinating payment dates with the availability of funds, you can maintain a balanced cash position and prevent unnecessary strain on your working capital.

Implement Vendor Management Strategies: Regularly review and assess your vendor relationships to identify opportunities for improvement. Consolidating vendors, renegotiating terms, and fostering strong communication can lead to enhanced efficiency and cost savings.

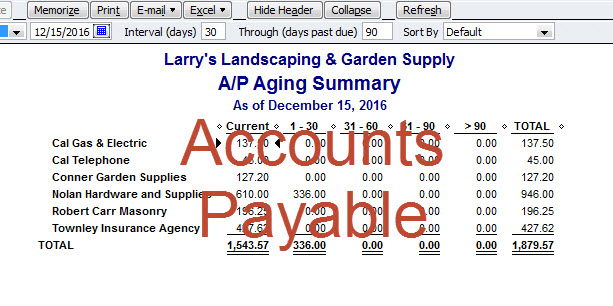

Monitor and Analyze Accounts Payable Aging: Keep a close eye on your accounts payable aging report to identify any overdue payments or recurring issues. By promptly addressing outstanding balances, you can maintain healthy vendor relationships and avoid potential penalties or disputes.

Embrace Technology Solutions: Explore accounting software and tools specifically designed to optimize accounts payable management. These solutions can automate processes, provide real-time insights, and simplify reconciliation, reducing manual errors and enhancing efficiency.

By implementing these strategies and continually monitoring your accounts payable turnover, you can improve cash flow management, reduce financial risks, and ensure smoother interactions with creditors and vendors. For more valuable information on bookkeeping and related topics, we offer a wealth of additional articles to support your financial knowledge and success.

Accounts Payable Articles

- Accounts Payable Recording Outstanding Bills

- Accounts Payable and the ACA in Santa Rosa

- Accounts Payable and the Self Employment Tax

- Accounts Payable Journal Entries

- Accounts Payable Journal Entries for IRS Audit

- Accounts Payable Petaluma

- Accounts Payable Santa Rosa

- Accounts Payable Affect Cash Flow

- Accounts Payable In Santa Rosa

- Accounts Payable JE's for Growing Businesses

- Accounts Payable Spreadsheet

- Auditing Accounts Payable

- Bookkeeping Services and Accounts Payable

- Calculating Accounts Payable

- Accounts Payable Journal Entry

- Ideal Accounts Payable Turnover

- Improve Accounts Payable Turnover

- Accounts Payable and Minimum Wage Increases

- Streamlining Accounts Payable

Please subscribe to my monthly newsletter, Bookkeeping Basics E-zine. It tells you every month about the new information that I have added, including some great tips and advice from myself and other Bookkeeping Basics readers.

Like Bookkeeping-Basics.net?

- Home

- Accounts Payable

- Improve Accounts Payable Turnover

New! Comments

Have your say about what you just read! Leave me a comment in the box below.