- Home

- Questions and Answers

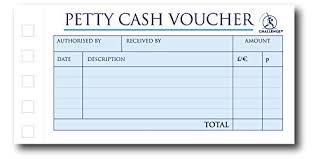

- Petty Cash Reimbursement

Business Owner Petty Cash Bookkeeping Question

by Wan

(Sydney )

Here is the question: A business owner used company petty cash to bought flowers for his wife, how to enter in Cash Payment journal?

Does it affect the Drawings Account? Please kindly answer this question, thanks!

Comments for Business Owner Petty Cash Bookkeeping Question

|

||

|

||

|

||

How To Record Liquidation of Petty Cash Fund in a Cash disbursement book?

From last month petty cash, there is a balance forwarded of $500. Then another check with the amount of $4,500 was issued to replenish the monthly petty cash of $5.000? How will I record it in the cash disbursement book?

Hello and thank you for your question.

You will record the replenishment of the monthly petty cash in the cash disbursement book as follows:

DEBIT $4,500 to Petty Cash

CREDIT $4,500 to Bank Account

Petty Cash Fund

The new business I work for does not have a petty cash fund physically located in our office, but monies are transferred from our regular checking account into the special account for Petty Cash.

The process we use for giving petty cash is by check request. When we make the checkout is it best to make it out to "cash" or to the individual?

When I cut the check which account should be debited? Should I set up an account called "Petty Cash Expense"? Or is it okay to debit the Cash account called Petty Cash?

I hope that my questions are not farfetched.

Thank you in advance for your help.

Angela

Comments for Petty Cash Fund

|

||

|

||

Petty Cash

by Nina

(Vancouver, BC, Canada)

My bookkeeping setup a $500 petty cash. When I had my receipts for $473 I entered in Simply Accounting as a purchase invoice for petty cash detailing for office supplies, postage, etc. then I posted, and made a cheque for the $473 and posted the payment of the entry for $473. Next time I had receipts for 558.67 and I did the same, and the last time for year end I had to do my petty cash and it was for $635.58 and I did the same, now that I read your article I realized that I am doing wrong, how could I fix it? Thank you, Nina

Petty Cash Post

by Liming Jiang

(Canada NS)

Hi, Petty Cash is post to deposit(revenue) account, cheque is out. Now I am doing bank reconciliation, how can I fix it?

Thank you so much,

Liming

Petty Cash Adjustment

Sep 01, 2010

Rating

Petty Cash adjustment

by: Anonymous

I just took a new position with a company. I found that the former bookeeper entered the original petty cash account at $750.00. The owner just asked me to lower the account to $350.00 per month. I did a journal entry crediting petty cash to lower and debiting the checking account. Although this looks good on paper, does the owner need to hand the $350.00 in cash over to be deposited into the checking account? If so, how should we code that cash deposit? I dont want it to throw off the checking account when I go to reconcile.

Thank You

Petty Cash Entry After Liquidation.

by Cecille

(Antipolo City, Manila Philippines)

How will I record petty cash liquidation to Cash disbursement book?

Petty Cash in Simply Accounting

I want to set up Petty Cash thru Simply Accounting. What are the general journal entries to set up PCash, how do i enter the expenses and then finally, how do i replenish the PCash?

Thank you,

Sara

Hello Sara,

Thank you for your question.

Using a $500 dollar balance, you will setup petty cash as follows:

CREDIT 500 Cash Account (Asset)

DEBIT 500 Petty Cash Account (Current Asset)

Using 350 in example expenses, you will enter the expenses as follows:

DEBIT 50 Postage Expense

DEBIT 20 Printing Expense

DEBIT 10 Tolls Expense

DEBIT 270 Office Expense

CREDIT 350 Petty Cash

You will record the replenishment as:

CREDIT 350 Cash

DEBIT 350 Petty Cash

Petty Cash Not Entered Into Accounting Program

by Joe

Hi,

I have just taken over an Administrative Assistant position from someone that was there for many years. She did not enter petty cash into the accounting program and just did it by hand in a general journal.

I want to set up the petty cash account from where she left off. I don't know what the general journal entries would be in Simply Accounting. I have $30 as a PCash starting balance, $107 in expenses and I would like to replenish the pcash total amount to be $150.00.

Please help!

Thanks,

Joe

Hello Joe,

Thank you for your question.

Your entry for the starting balance and expenses is:

$ 30 DEBIT to Petty Cash (Asset Account)

$107 DEBIT to Office Expenses (Expense Account)

$137 CREDIT to Opening Balance Equity (Equity Account)

Your entry for replenishing the account to $150 is then:

$120 DEBIT to Petty Cash Account (150-30=120)

$120 CREDIT to Bank Account

Petty Cash Reconcilliation Form

Hi,

Do you have a sample petty cash reconciliation form that I could use? I find petty cash so confusing so if I can see a form, it will help me with the reconciling.

Thank you for all of your help!

Joe

Petty cash replenishment

by Laura

(BC, Canada)

Can you use the cash payments journal to record the replenishment of your petty cash, or should this entry be made in the general journal?

You can use both the cash payments journal or the general journal to replenshish your petty cash.

Using the cash payments journal, you would simply enter the amount as a payment and enter petty cash as the account for the transaction.

Using the general journal, you would credit the bank account and debit the petty cash account.

Setting Up Petty Cash

I am setting up Petty Cash for the first time in my accounting software. Petty Cash existed before but it was manual and the records were done manually. I want to move forward from today on and set it up thru the accounting software. So that being said, what would the general journal entry be to set up petty cash to $300.00? (The check from the bank will be made out to A. Adams Petty Cash, office manager)

All of the previous receipts come to a total of $141.12. What is the general journal entry for these? Once the 2 entries above are entered, what is the entry to replenish the petty cash back up to $300.

I hope this isn't too confusing...this is too confusing for me!

Many thanks!

Jamie

Hello Jamie,

Thanks for your question, lots of people find petty cash confusing! :)

The journal entry to setup petty cash to 300 is:

DEBIT 300.00 Petty Cash

CREDIT 300.00 Cash

The jounal entry for the receipts totaling 141.12 using one general account is:

DEBIT 141.12 Office Expenses

CREDIT 141.12 Petty Cash

The journal entry to replenish petty cash back up to 300 is:

DEBIT 141.12 Petty Cash

CREDIT 141.12 Cash

Thanks again for your question.

Comments for Setting Up Petty Cash

|

||

|

||

Petty Cash Reimbursement

I use QuickBooks 06 non profit:

If someone needs cash and writes a check to our business for $20.00, do I post it to the petty cash account or to the in and out account?

Please subscribe to my monthly newsletter, Bookkeeping Basics E-zine. It tells you every month about the new information that I have added, including some great tips and advice from myself and other Bookkeeping Basics readers.

Like Bookkeeping-Basics.net?

- Home

- Questions and Answers

- Petty Cash Reimbursement