Account Register Is Off

by B Harkness

(NYC)

Account Register

My account register displays a negative balance even though I reconcile it monthly. How can I correct the register balance or determine the accurate account balance?

Account Bookkeeping Question

Account Bookkeeping Question

When you make a payment for office supplies that were purchased on account in June, which accounting accounts are impacted?

Bank Accounts Not Reconciled for Years

Bank Accounts Reconciliation

Hi, I recently started a new position with a company. I have no accounting training other than I have worked in Accounts Payables before for 6 months. The main person in charge of all the accounting transactions and bank balancing and reconciliations has not been doing it for a long time.

There is a Bank Operating Clients Trust Account which has not been reconciled since 2000. There is a Bank A Security Deposit Clients Trust Account which has not been reconciled since 2015. There is also a Bank B Security Deposit Clients Trust Account which has not been reconciled since 2015.

So, my boss has asked me to get all the reconciliations current because he was unaware, they were not being done, which he knows was his error for not making sure it was done. The person who was supposed to be doing it has been here since 2000.

So, I have come across many discrepancies and there are red flags for fraudulent characteristics and activity which I have researched. I have told my boss and so he would like to at least just start in 2017 and then for all the pre 2017 stuff I believe he plans to hire out or deal with after he has time to process all of this.

I can't use our software to reconcile because it won't let you skip years of reconciliations. My questions is would it be best to start January 2017 and then just get one big figure for him to get account correct and then go back to research later. Or should I just start in 2015 and as discrepancies come up add adjustments? Thanks for any help or advice please.

Bookkeeping Ledger Accounts

Bookkeeping Ledger Account

If a firm purchases office equipment which account should record the purcase the purchase account? Or do you make an office equipment account?

Clearing Accounts

by Karen

(Montana)

Clearing Accounts

In the bar/restaurant industry, what is the purpose of "clearing" accounts like ATM clearing, and how are they reconciled?

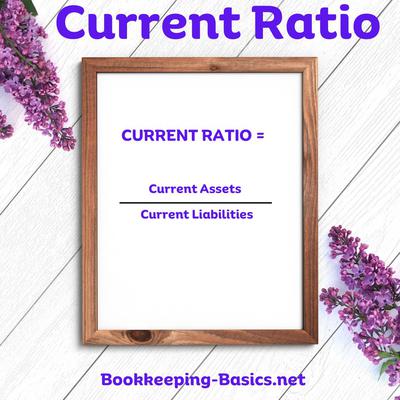

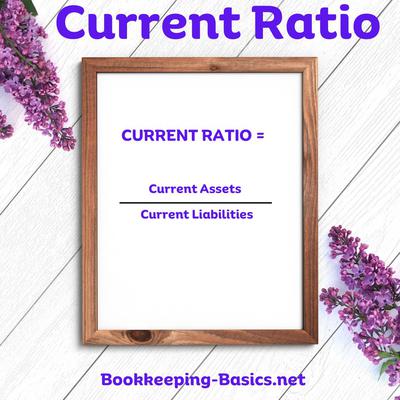

Current Ratio Account

Current Ratio Account Explained

What is current ratio? What is the formula for finding the current ratio?

Free Reserve Account

Reserve Club Account

What is meant by free reserve in a club account?

Handling Pass-Through Account Transactions

by Jennifer

(Sunrise, FL, USA)

Pass-Through Account

I'm assisting a company that acts as an intermediary between a title company and county courthouses. They receive funds from the title company, from which they pay the county, retaining only an $8 service fee per transaction. How can I correctly itemize the invoice to ensure the county fee isn't recorded as revenue, given that it's immediately remitted to the county?

IT Accounts on sage

IT Company Account

When accounting for an IT company using Sage, should I categorize server and website costs as direct expenses, or should I consider them as overheads?

Juggling Two Bank Accounts

Inter-Account Transfer

We have two businesses. One bank account I'll call Account A and the other Account B.

Account A has debit transactions that should have been made into Account B.

Is there a way to properly get that info into the Account B where it should have originated?

Reviewing a Clients Account

by Keisha

(Bronx, NY)

Client Account Review

What do I look for when reviewing a clients account?

Shareholders Account

by Tracy

(Vancouver, BC)

Shareholders Account

The owner has been purchasing supplies using cash and his personal Visa. I have created a Due to Shareholders account in QuickBooks. I have entered these entries by crediting Shareholders account and debiting the account of what was purchased, for example, office supplies.

My question is he periodically takes cash out of the business account, $100.00 here and $40.00 there. I know I have to now debit Shareholders account and credit another account.

My problem is I don't know what account to credit. I know it should be what he has purchased throughout the month, but I can't tell what he is paying himself for because he just takes out money here and there.

Should I create another account in QuickBooks to debit when he takes out cash?

Stock In Ledger Account

by Lucky Sharma

(Ambala Cantt)

Stock In Ledger Account

If there's outstanding stock recorded in a ledger account and the business needs to register or update its details with the sales tax department, what steps should be taken?

Withdrawal Account

by Annie

(Hong Kong)

Withdrawal Account

In a Partnership company, what does Withdrawal account come under: Assets, current assets, liabilities, current liabilities or any other? Thanking you.

Like Bookkeeping-Basics.net?

Thank you for visiting ..

Before you go, please fill out the form below to start getting valuable money saving tips for you and your business now!