- Home

- Accounts Payable

- Auditing Accounts Payable Santa Rosa

Auditing Accounts Payable Santa Rosa

Assure Accuracy and Compliance

Our webpage on "Auditing Accounts Payable Santa Rosa" provides valuable insights and guidance to help you conduct thorough audits of your A/P function. Are you a business owner or financial professional in Santa Rosa seeking to ensure the accuracy and compliance of your cash flow processes?

Discover best practices for verifying vendor invoices, reconciling payments, and detecting potential errors or fraudulent activities. Learn about the importance of maintaining accurate records, implementing internal controls, and adhering to legal and regulatory requirements.

With our comprehensive resources and expert advice, you can gain confidence in the integrity of your accounts payable process and mitigate financial risks. Don't leave your financial operations to chance – visit our webpage on Accounts Payable Questions and Answers to enhance the efficiency, accuracy, and compliance of your accounts payable function.

You will surely be surprised to know that many small businesses do not believe they need to worry about auditing their books. However, our experience as bookkeepers for many small to medium sized businesses have taught us that even if you have only a few employees or keep your books yourself, auditing your accounts payable and other financial statements are much more important than you realize.

Therefore, it's important to understand the variety of definitions the word audit can have. Not every audit looks like the image you may have of the IRS coming into your business and tearing your paperwork apart. Even looking over your accounts payable at the end of the day is a kind of audit. Simple audits, performed regularly, can make sure that problems in very important areas such as your accounts payable and inventory are caught early and don't have a chance to develop into major issues.

Auditing Accounts Payable Santa Rosa - Internal Audits

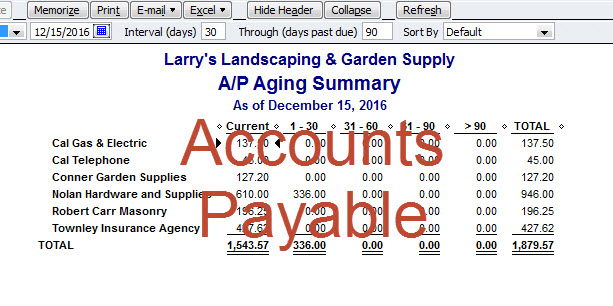

The most basic form of internal audit is daily and monthly reconciliation of your company's books. Auditing accounts payable Santa Rosa in particular should be reconciled daily to make sure all payments have been recorded correctly and any bank deposit is correct. Closing the books at month-end allows you to review amounts in areas where errors are likely to crop up:

- accounts payable

- accounts receivable

- inventory

- petty cash expenditures

Internal audits are performed by you or another employee to ensure that your numbers are adding up and any employees who help with your professional bookkeeping services are in compliance with the procedures you have set up for them. You can start with a simple overview of your accounts payable and a review that internal controls like signing off on transactions are being followed.

For most small businesses, the most critical area is accounts payable. Because accounts payable are handled by your front-line employees, from cashiers to receptionists, they are the most likely to be misunderstood. A single cash-handling employee who doesn't think precision is important in recording accounts payable can, in the long run, complicate all of your records.

Larger businesses with dedicated bookkeeping teams and bookkeeping services often take it a step further, requiring that employees take regular vacations. During their absence, any problematic behaviors (anything from incorrectly entering accounts payable to embezzlement) are likely to come to light. Whether you think your business requires this level of internal audit is up to you.

Auditing Accounts Payable Santa Rosa - External Audits

External audits can be as complicated as a visit from the Internal Revenue Service or your state's equivalent, but it can also be as simple as hiring an outside bookkeeping firm who provides outsourced bookkeeping services to perform an audit for you. If you keep your own books, or you're not comfortable looking over the nitty-gritty details of accounts payable, this solution can save you a lot of time and stress.

If you are informed that you're having an external audit imposed on you, the best thing you can do is to find a professional to review your paperwork with you, make sure everything is in order, and help present your case to the external auditors.

It's critical for small business owners to

understand the importance of audit procedures and make sure that they are being

implemented in their business. Your business is only as good as the numbers that

it runs on, and errors or malicious intent can be hidden for a long time if

your books are not subject to review. While audits can seem intimidating, they

are often much less complicated than owners imagine.

Auditing Accounts Payable Guidance

The Auditing Accounts Payable Santa Rosa webpage offers valuable resources and guidance for businesses looking to ensure the accuracy, compliance, and integrity of their a/p processes. This comprehensive webpage provides insights on best practices for auditing accounts payable, verifying invoices, reconciling payments, and detecting potential errors or fraudulent activities.

By implementing the recommended strategies and internal controls outlined on the webpage, businesses can enhance the efficiency of their accounts payable function while mitigating financial risks. Whether you are a business owner or a financial professional, I hope this page equips you with the knowledge and tools to conduct thorough audits and maintain a robust and reliable accounts payable system.

More Accounts Payable Articles

- Accounts Payable Recording Outstanding Bills

- Accounts Payable and the ACA in Santa Rosa

- Accounts Payable and the Self Employment Tax

- Accounts Payable Journal Entries

- Accounts Payable Journal Entries for IRS Audit

- Accounts Payable Petaluma

- Accounts Payable Santa Rosa

- Accounts Payable Affect Cash Flow

- Accounts Payable In Santa Rosa

- Accounts Payable JE's for Growing Businesses

- Accounts Payable Spreadsheet

- Auditing Accounts Payable

- Bookkeeping Services and Accounts Payable

- Calculating Accounts Payable

- Accounts Payable Journal Entry

- Ideal Accounts Payable Turnover

- Improve Accounts Payable Turnover

- Accounts Payable and Minimum Wage Increases

- Streamlining Accounts Payable

Please subscribe to my monthly newsletter, Bookkeeping Basics E-zine. It tells you every month about the new information that I have added, including some great tips and advice from myself and other Bookkeeping Basics readers.

Like Bookkeeping-Basics.net?

- Home

- Accounts Payable

- Auditing Accounts Payable Santa Rosa

New! Comments

Have your say about what you just read! Leave me a comment in the box below.