- Home

- Accounts Payable

- Accounts Payable Petaluma

Accounts

Payable Petaluma

What Every Business Owner Must Know

Accounts Payable Petaluma - As a new or experienced business owner, what must you know about your business' money owed?

Well, let’s first start by saying: Congratulations since you’ve taken a leap of faith not everyone is brave enough to do. Owning your own business requires belief in yourself and the ability to have a vision and go after it. There are many aspects of owning a business and keeping a great set of books will go a long way in establishing your business as a viable entity.

Therefore, it should come as no surprise that you should be familiar with some basic financial or bookkeeping terms so that discussions with your CPA or bookkeeper don’t sound like a foreign language to you. Accounts receivable (A/R) and accounts payable (A/P) are two key bookkeeping principles and terms that every business owner should clearly understand. So as not to overload you with too much information the dynamics of A/P will be reviewed first.

What is Accounts Payable Petaluma?

Accounts Payable (A/P) is a crucial component of managing your business's finances. It represents the short-term liabilities that your business owes to vendors and suppliers for goods and services purchased on credit. As a small to medium-sized business owner, your specific types of payables may vary depending on your industry and unique business needs.

For retailers, vendor invoices for inventory purchases form a significant portion of their short-term payables. These expenses are recorded as liabilities on the balance sheet, reflecting the amount owed and the payment terms agreed upon with the vendors. Proper management of accounts payable ensures timely payment to vendors, maintaining good relationships and a smooth supply chain.

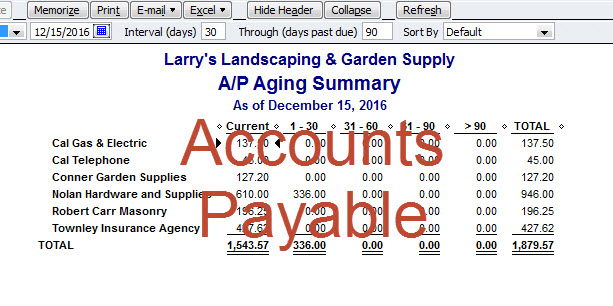

Effectively tracking and managing accounts payable is essential for accurate financial reporting and maintaining the financial health of your business. It involves processes such as verifying invoice accuracy, matching invoices with purchase orders and receiving documents, and ensuring timely payments to vendors. Failing to manage accounts payable efficiently can lead to strained relationships with suppliers, late payment penalties, and a negative impact on your cash flow.

By diligently monitoring and controlling accounts payable, you can optimize your cash flow, take advantage of early payment discounts, negotiate favorable payment terms with vendors, and maintain a positive reputation as a reliable and responsible business partner.

At Bookkeeping-Basics.net, we understand the significance of accounts payable in the financial operations of your business. We provide resources, guides, and expert advice to help you effectively manage your accounts payable processes. Our goal is to empower you with the knowledge and tools necessary to streamline your payables, strengthen vendor relationships, and maintain financial stability.

Whether you are new to managing accounts payable or looking to enhance your existing practices, we are here to support you. Explore our website for valuable insights, tips, and resources to optimize your accounts payable management and drive the success of your business.

Accounts Payable and Cash Flow

Managing your Accounts Payable in Petaluma has a direct impact on your business's cash flow. By understanding and closely monitoring your payables, you can make strategic decisions to optimize your cash position. One effective approach is to negotiate favorable payment terms with your creditors, such as extending the payment period from 30 days to 45 days.

Extending payment terms provides you with the opportunity to hold onto cash for a longer period, which can be beneficial for managing your working capital and meeting other financial obligations. This strategy is particularly advantageous with vendors you have established good relationships with, as it allows for flexibility and strengthens partnerships.

Accounts Payable affect cash flow and is considered an asset or available credit for your business. On your general ledger, cash accounts typically have a debit balance, while the Accounts Payable account has a credit balance. When you make a payment on an invoice, you are debiting your cash account, reducing your cash balance, and crediting your Accounts Payable account, reducing your payables balance. Accurate and up-to-date Accounts Payable balances are crucial for maintaining the integrity of your financial records and ensuring accurate financial reporting.

At Bookkeeping-Basics.net, we understand the importance of managing your Accounts Payable effectively. We provide valuable resources, tips, and guidance to help you navigate the complexities of payables management. Whether you are looking to negotiate payment terms, streamline processes, or improve cash flow, our platform offers the information and support you need.

Take control of your Accounts Payable in Petaluma and unlock the potential for improved cash flow and financial stability. Explore our website for comprehensive insights and practical advice on managing your payables and achieving your business goals. Contact me if you have any questions or need further assistance.

Recording Accounts Payables

Even if your business is small the proper recording of items is still important to you. If managing your own bookkeeping, then start off by using inexpensive or free bookkeeping software. Your bank may provide free online tools.

Bookkeeping software will allow you to set up repeating payments and provide tips for the correct account allocations. Once you take the time to set-up repeating vendors, paying bills will go quickly. Make sure you use calendar software for bill alerts so that you are paying your invoices timely. Slow pays or missing payments will negatively impact your credit rating and your ability to secure more credit if needed.

Accounts Payable Articles

- Accounts Payable Recording Outstanding Bills

- Accounts Payable and the ACA in Santa Rosa

- Accounts Payable and the Self Employment Tax

- Accounts Payable Journal Entries

- Accounts Payable Journal Entries for IRS Audit

- Accounts Payable Petaluma

- Accounts Payable Santa Rosa

- Accounts Payable Affect Cash Flow

- Accounts Payable In Santa Rosa

- Accounts Payable JE's for Growing Businesses

- Accounts Payable Spreadsheet

- Auditing Accounts Payable

- Bookkeeping Services and Accounts Payable

- Calculating Accounts Payable

- Accounts Payable Journal Entry

- Ideal Accounts Payable Turnover

- Improve Accounts Payable Turnover

- Accounts Payable and Minimum Wage Increases

- Streamlining Accounts Payable

Please subscribe to my monthly newsletter, Bookkeeping Basics E-zine. It tells you every month about the new information that I have added, including some great tips and advice from myself and other Bookkeeping Basics readers.

Like Bookkeeping-Basics.net?

- Home

- Accounts Payable

- Accounts Payable Petaluma

New! Comments

Have your say about what you just read! Leave me a comment in the box below.